Download Quicken For Mac Australia

Quicken 2009 Home & Business

Can I download the Quicken for iMAC from Australia? Where to find a Help Guide for Quicken for Mac? Quicken Mac FAQ list; Quicken Windows FAQ list. As long as you do not want to download data from non-US and non-CA FIs/Banks directly, you can still use these products. You can set your base currency to. Help with Aussie alternative to Quicken finance software. Yes, we currently have many Australian users connecting via our Direct Access service in order to download transactions from Australian Banks. Sadly, there is no version of Quicken for Mac for Australia.

Pros

Most comprehensive personal finance manager available. Connects to multiple types of accounts. Revamped user interface. Online bill-pay. Can track your home's value. Robust planning and investing tools. Dozens of report templates. Enhanced mobile app.Cons

Can't access all data remotely. User interface still looks dated. Tools don't co-exist smoothly.Bottom Line

No other personal financial management application offers the depth and breadth of tools found in Quicken, but its very completeness can be overwhelming.

Quicken, after 25 years of existence, has finally launched something that users have wanted in the personal finance app for a long time: a companion website that mirrors the features and information found in the desktop version. Now, you can work on much of your Quicken data in a web browser, from anywhere, since the data is stored in the cloud and syncs with your desktop file. The new web access capabilities also take away some of Quicken's intimidation factor and makes it more competitive with state-of-the-art personal finance websites. As a result, Quicken is the Editors' Choice for paid personal finance services.

The new virtual tools are available for all versions of Quicken 2018 and 2019, which is a major improvement. As Quicken has matured over the years, it's become so feature-heavy and slow on older PCs (though the 2019 version offers many performance improvements) that it's just too much for some users—and too expensive. But there's no denying that it's the most feature-rich personal finance application available today.

Versions and Pricing

There are four versions of Quicken 2019. All let you download transactions so that you can get a comprehensive view of your finances through a variety of lenses. You can simply track your income and expenses, create budgets, and run reports in the most junior version. If you want to view and manage your investments, track your property and debt, pay bills online, and do long-term planning, you'll find tools for those actions in the more advanced plans. Quicken's newest tools—especially the companion website—offer a state-of-the-art user experience, but make older features look dated by comparison.

Quicken launched a membership program with its 2018 version. Instead of paying for the application upfront, you now pay for a one- or two-year membership and receive upgrades as long as you maintain your subscription. Quicken Starter ($34.99 per year) is best for consumers who just want to connect to their online financial accounts and track income and expenses, monthly budgets, bills, reports, calendars, and alerts. The version tested here, Quicken Deluxe ($49.99), adds sophisticated investment tracking. Quicken Premier ($74.99 per year) offers Quicken BillPay and priority access to customer support. Quicken Home & Business ($99.99 per year) allows you to track business data as well as personal income and expenses.

The competition has grown steadily, though, as you can see from our reviews of rival personal finance web services, such as Credit Karma, NerdWallet, and Mint, the Editors' Choice for free personal finance services. With those services, you can get a lot of good personal finance functionality for little or no monthly cost and have anytime, anywhere access.

Some Setup Required

Quicken 2019 comes ready to use, but there are some setup chores you should do to make it work the way you want. Open the Edit menu in the Windows toolbar, select Preferences, and choose from options related to program functions like navigation, the register display, and downloaded transactions. Of course, you'll need to connect your online accounts if you want Quicken to import cleared transactions from your financial institutions. The software supports spending and saving, property and assets, investing and retirement, and debt accounts. You usually just supply the user name and password that you use to log in to these online accounts to set up the connection. Mint and other competitors work similarly.

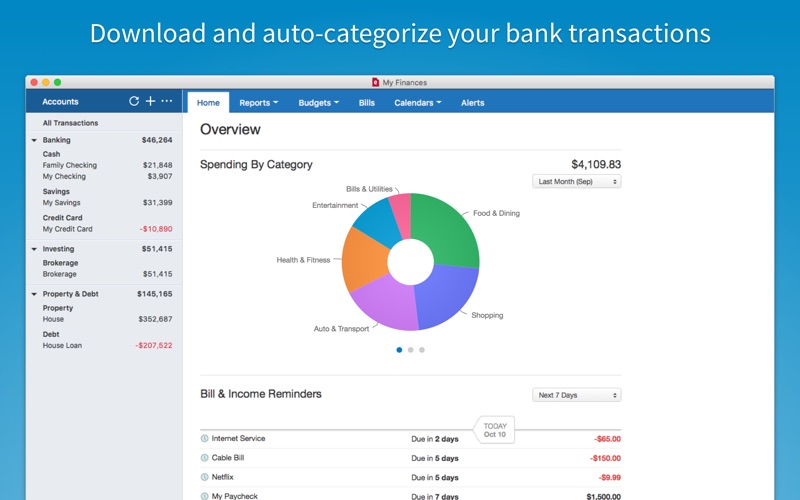

Quicken looks and works much like it did previously, though, as noted earlier, its performance has improved. The home page is designed to give you a thorough overview of your finances. The left vertical pane displays all of your accounts: Banking, Investing, Property & Debt, Planning, and Tax. Clicking on any of these takes you to a more detailed view. Your net worth appears at the bottom of the pane, as well as a link to your credit score. To get your credit score, you must sign up for Quicken's free service. Unfortunately, Quicken's free credit score is only updated quarterly, as opposed to Credit Karma's weekly updates.

The home page is highly customizable. You can choose from numerous types of tables, charts, and other graphical content to display there. You could, for example, choose a calendar that shows what happens every day, such as expected income and upcoming expenses or overdue transactions. There are lists of bill and income reminders, graphs illustrating total spending by category, asset allocation charts, and budget adherence reports. You can also save multiple views containing different groupings of content.

Comprehensive Coverage in Quicken

Quicken has for many years included some tools that many people will never use, such as long-term planning tools and the more sophisticated investment- and property/debt-tracking features. But they're there and stay out of your way when you don't need them. If you're not familiar with Quicken, you should click through the program tabs (such as Investing and Property & Debt) at some point, as you might find something you'd like to explore. But the sheer volume of tools available can be overwhelming. No one else comes close to providing such a wealth of guidance and tracking tools in either a software or web-based application.

Take the Planning interface, for example. Budgets is likely the most used tool in this section. Here, Quicken Deluxe lets you create multiple budgets based on categories you choose. You can view your progress in an easy-to-understand graphical format. Other features in this section help you reduce debt, make a lifetime plan, track and project income taxes, and establish savings goals. These interactive tools combine fill-in-the-blank fields, sophisticated calculators, and reports. They then feed your responses back to you as graphs and tables.

If you have an investment portfolio, you can track prices during the market day; see detailed views of individual securities; monitor and change your asset allocation; and estimate capital gains. Property owners (vehicle, home, or other assets) can use a wizard to create accounts for assets and track their progress toward ownership.

If you have enough financial resources that you'd make use of all of Quicken's personal finance tools, you'll be spending a lot of time keeping the software current. Such compliance can result in meaningful feedback and guidance from Quicken, but it takes constant commitment. It's not something you can do half-heartedly. A financial professional can run similar numbers for you and can go a step further using more sophisticated tools, offering expert, personalized advice that Quicken can't. It depends on how diligent you want to be and your confidence level.

Spending and Income

From its earliest days, Quicken has focused on personal income and spending. If you only use the software to track your money (including investments) and don't access its longer-term planning and tracking tools, it's worth the few dollars per month that you pay in subscription fees for Quicken Deluxe as opposed to Starter.

Click the Spending tab, and you arrive at a big, colorful chart that illustrates your spending by category over the last 30 days. You can modify this date range to cover alternate periods and view the graphic by individual or all accounts. Below that is a register containing transactions that have been imported from your financial institutions or entered manually.

You can toggle this register to reflect either income or spending and access tools that let you really micromanage your transactions. The transaction options include splitting them; adding notes, flags, and attachments; changing categories; and assigning tax lines. Accurate categorization of your transactions is very important. It makes your reports more useful and your taxes correct should you use Quicken data to help prepare your income taxes.

The Bills and Income tab deals primarily with your incoming bills. You can enter each manually or connect to online billers where you have accounts to download the pertinent details, and view the list by biller name, due date, or as a graphical calendar. Once a bill has been added, you can edit it (once or for all future occurrences), mark it as paid, and enter it as a transaction in the appropriate register.

Income is also addressed in this section of Quicken, which is puzzling at first. I would have expected to see it grouped with spending. But the logic becomes clear after you see that not only can you track your income in multiple views, but you can also see a chart that projects your account balances based on upcoming bills and income. What you can't do, though, is actually pay bills electronically in Quicken Deluxe. You'd need one of the two more expensive subscriptions for that. You can, of course, print checks.

Excellent Support

Quicken has a learning curve. It takes some time to simply learn what it can do and how each area of the software integrates with the others. But you don't have to explore everything. Quicken has a huge range of capabilities that have been added on over the years; you can either use or ignore them.

If you do choose to tackle the more sophisticated features, there's plenty of support available. There are written guides and videos, an active online community, and FAQs. You can also chat with a support agent 24/7 or call one Monday to Friday from 5 a.m.-5 p.m. Pacific Time.

Accessing Quicken Remotely

As robust as Quicken is, you wouldn't expect to be able to access the lion's share of its features remotely. And you can't. iOS apps and Android apps are available. These apps include the tools and data you most likely need when you're away from your computer. You can view and add account registers and transactions and see charts illustrating your spending categories and overall spending and income. Your investment portfolio is even available, albeit not with all the complex desktop-based tools.

As mentioned earlier, the new browser-based companion to desktop Quicken (app.quicken.com) takes some of the intimidation factor out of the software for individuals who aren't power users (though those people would likely find it helpful, too). The site's dashboard is terrific, and may be all you need to look at for a quick overview. It displays tables and charts that show you, for example, how you're doing with spending and income and your most recent transactions.

Between this home page and its links, you can view your account balances and their corresponding registers; work with and add transactions; see how you're meeting your budget goals; and watch your investment portfolio prices in real time. Though it doesn't include every feature in Quicken's desktop version, the web version gives you the numbers you'd most want to see when you check in.

Quicken Excels

If you're considering a personal finance application for the first time, we'd suggest you start with Mint, our five-star Editors' Choice for free personal finance services, as it doesn't require a financial commitment.

That said, Mint is a web-based affair, and many people prefer a dedicated desktop app. That's where the 2019 edition of Quicken Deluxe shines. You'll pay an annual fee, but Quicken Deluxe includes excellent reports, transaction tracking, and good support. Toss in the new, optional web-based interface, and Quicken is a PCMag Editors' Choice.

Bottom Line: Quicken Deluxe contains more personal finance management tools than any competitor, but it's relatively expensive and many features aren't available in the mobile apps.

Screenshot of Quicken 2005 Premier Home & Business | |

| Developer(s) | Quicken Inc. |

|---|---|

| Initial release | 1983; 37 years ago |

| Stable release | |

| Operating system | MS-DOS, Apple II, Windows, Classic Mac OS, macOS, iOS, Android |

| Type | Personal financial management software |

| License | Proprietary |

| Website | quicken.com |

Quicken is a personal finance management tool developed by Quicken Inc. (formerly part of Intuit, Inc.). On March 3, 2016, Intuit announced plans to sell Quicken to H.I.G. Capital; terms of the sale were not disclosed.[1]

Different (and incompatible) versions of Quicken run on Windows and Macintosh systems. Previous versions ran on DOS[2] and the Apple II.[3] There are several versions of Quicken for Windows, including Quicken Starter, Quicken Deluxe, Quicken Rental Property Manager, Quicken Premier, and Quicken Home & Business, as well as Quicken for Mac.[4] Since 2008, each version has tended to have the release year in the product name (e.g., Quicken Basic 2008); before then, versions were numbered (e.g., Quicken 8 for DOS).

Quicken's major marketplace is North America, and most of the software sold is specialized for the United States and Canadian marketplace and user base. But the core functions can often be used more widely, regardless of country; and versions have been tailored for a variety of marketplaces, including Australia, Germany, Hong Kong, India, New Zealand, the Philippines, and Singapore.[5] Development of the UK-specific version of Quicken was stopped in January 2005, with sales and support ending shortly afterwards. There were also versions for Argentina, Brazil, Chile, Colombia, Costa Rica, Denmark, Ecuador, France, Mexico, the Netherlands, Spain, Sweden, Switzerland, Uruguay, and Venezuela.[5]

Product description[edit]

The Quicken name typically refers to the core product offering of personal financial management software. The software includes financial planning activities that, historically, people may have done on paper – recording banking transactions, planning a budget and measuring progress against it, tracking investments and their prices and performance. Quicken has offered various editions, with varying prices – such as Basic which includes only those typical activities for someone with simple banking accounts, to Small Business for someone who also runs a business out of their home.

Quicken includes online services that allow users to retrieve transactions from various providers – such as their bank or credit card company. In most cases, online services and technical support are now supported for up to three years after the product's labeled version. e.g. Quicken 2018 will be supported until 2021.[6]

Related products[edit]

The Quicken brand has been extended to other personal and household areas, including healthcare. Quicken Health Expense Tracker is a free online tool for healthcare consumers enrolled in participating health plans. Users can 'manage and direct their health care finances, view and organize medical expenses, payments and service histories, and download and organize personal health claims data.'[7] The Quicken Medical Expense Manager is a desktop software tool for managing healthcare paperwork, tracking claims and payments, and consolidating related information.

Quicken Kids & Money was a Web-based program that aimed to help parents teach five- to eight-year-old children how to earn, spend, save, and share money. It is defunct.[8]

Other products are aimed at home business and seem to fit in a space for a less formal business than would be using QuickBooks. Quicken Rental Property Manager is a desktop software tool for managing rental properties; tracking tenants, expenses, and payments; and producing tax reports.

Software as a service[edit]

Quicken Online was a free, hosted solution (see software as a service) by Intuit. Intuit hosted all of the user's data, and provided patches and regularly upgraded the software automatically. Initially this was launched as a monthly paid subscription, and was a free service for over a year.

Intuit completed the acquisition of competitor Mint.com on November 2, 2009.[9] Quicken Online was discontinued on August 29, 2010, and users were encouraged to transition to Mint.com.

Beginning with Quicken 2018, Quicken is now a subscription service. Annual memberships can be purchased directly from Quicken.com and two-year subscriptions can be purchased through several retailers.[10]

Editions[edit]

The following are current (selling and supported) and retired (discontinued in both sales and support) versions of Quicken.

Current[edit]

Selling[edit]

- Quicken (Starter, Deluxe, Premier) 2019 for Windows[11]

- Quicken (Starter, Deluxe, Premier) 2019 for Mac[11]

- Quicken Home & Business 2019 for Windows[11]

Supported[edit]

(Dates support ends are shown.) [12]

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2017 - expires April 30, 2020

- Quicken 2017 for Mac - expires April 30, 2020

Retired[edit]

(Dates retired are shown.) [12]

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2016 - April 30, 2019

- Quicken 2016 for Mac - April 30, 2019

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2015 - April 30, 2018

- Quicken 2015 for Mac - April 30, 2018

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2014 - April 30, 2017

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2013 - April 30, 2016

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2012 - April 30, 2015

- Starter, Deluxe, Premier, Home & Business Edition 2011 - April 30, 2014

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2010 - April 30, 2013

- Starter, Deluxe, Premier, Home & Business 2009 - April 30, 2012

- Basic, Deluxe, Premier, Home & Business 2008 - April 27, 2011

- Basic, Deluxe, Premier, Home & Business 2007 - April 30, 2010

- 2006 (Win) – April 30, 2009

- 2005 (Win) – April 30, 2008

- 2004 – April 30, 2007

- 2003 – April 25, 2006

- 2002 – April 19, 2005

- 2001 – April 19, 2005

- 2000 – May 18, 2004

- 98 and 99 – April 20, 2004

- Version 6 for Windows. 'Designed for Windows 95. Release 6.0. (c) 1996'

- Version 3 for Windows 3.1

- Quicken Essentials for Mac - April 30, 2015

- Quicken for Mac 2007 - retired October 2016[12]

- Quicken Mac 2007 OS X Lion compatible - retired October 2016[12]

- Quicken for Mac 2006

- Quicken for Mac 2005 - retired April 30, 2015

Problems[edit]

Intuit stopped supporting its Quicken software in the United Kingdom in 2005, leaving many thousands of users with only partly functional software.[13] Fluenz spanish mac torrent.

In 2008 and 2009, Quicken users reported an unusually large number of software bugs for a commercial product.[14][15][16] A review of Quicken 2010 suggests that quality and user interface in that product year is dramatically improved.[17]

Existing Quicken Online users' data is not transferable/importable into Mint.com. This is in direct contrast to VP Aaron Patzer's promise, made on April 27, 2010: '[Until the merger with Mint.com is complete], you can continue to use Quicken Online just like you have. Once we have completed integrating all features to Mint, you will be able to easily transfer your information and data to ensure the smoothest transition possible.'[18]

In December 2019, Quicken software abruptly disabled bill-pay services through its Quicken Billpay affiliate, leaving all Quicken users without a fundamental feature of the software. Inquiries of the company were provided a form response that the disabling was a 'known issue' and 'This issue has been escalated to our Product Teams who are currently investigating the root cause of this behavior. At this time there isn't an ETA available.' Quicken bill paying continues to be inoperative as of December 27, 2019.[19]

History of Quicken and the absence of a common cross-platform file format[edit]

Quicken was originally written for MS-DOS and the Apple II back in 1983. The substantial differences between the Mac and these two platforms meant the later Macintosh version was written from the ground up. This lead to incompatibilities between the file formats for the earlier versions and the Macintosh version. The Windows version was designed to be compatible with the earlier DOS version's files.

Then when Mac OS X came out in 1999 (server) and 2001 (desktop), a new platform emerged. Apple developed backward compatibility for OS 9 (and predecessors), so Quicken for Mac development continued in an older platform database structure (PowerPC-based). Apple continued to support PowerPC-based apps (via Rosetta) on their Intel-based Macs in August 2009 (via Mac OS X 10.6). Rosetta was a temporary measure to support the eventual transition to exclusively Intel-based software (achieved in March 2011 with the release of OS X 10.7 (Lion)).

In 2009, faced with the eventual retirement of the PowerPC, it was deemed that the structure for Quicken for Mac (2007) was not suited for the direction of the Mac (intel) and OS X.[citation needed] Though they got Quicken for Mac 2007 to run on Intel in 2012,[20] Intuit decided to start from scratch and Quicken Essentials for Mac (QEM) was created in 2010.[21] Quicken 2015 for Mac, released in August 2014, and later versions for Mac are built on the Quicken Essentials for Mac foundation.

References[edit]

- ^John Rebeiro (March 3, 2016). 'Intuit selling Quicken to private equity firm HIG Capital'. pcworld.com. IDG Consumer & SMB. Retrieved March 4, 2016.

- ^'Quicken for DOS'. Intuit, Inc. Archived from the original on 2011-07-17.

- ^Field, Cynthia E. 'Quicken Offers Check Writing, Budget Analysis for Apple IIs'. InfoWorld. March 17, 1986: 35–36 – via Google Books.

- ^'All Quicken Products'. Intuit.

- ^ ab'International Versions of Quicken'. Intuit. 2011-06-20. Archived from the original on 2013-01-26.

- ^'Retirement of online services for older versions of Quicken'. Intuit/Quicken. Retrieved 2007-06-13.

- ^An April 2007 article in the San Jose Business Journal.

- ^'Quicken Kids & Money Help'. Intuit Inc. Archived from the original on June 21, 2008.

- ^'Intuit Press Release - Intuit Completes Acquisition of Mint.com'. about.intuit.com. November 2, 2009.

- ^'Quicken 2018 Subscription Membership Pricing Explained'. Top Financial Tools. 2017-10-27. Retrieved 2017-11-09.

- ^ abc'Quicken 2018 - Which Version Do You Need? Compare Quicken Products'. Top Financial Tools. Retrieved 2017-11-09.

- ^ abcd'Currently Supported Quicken Products (Discontinuation Policy)'. Quicken. 2016-02-09. Retrieved 2017-11-09.

- ^Oates, John (2005-01-17). 'Intuit UK kills Quicken and TaxCalc'. The Register. Retrieved 2009-04-06.

- ^nathanau (2008-01-27). 'Quicken Community - Quicken 2008 Bug List'. Quicken Community. Archived from the original on 2009-02-09. Retrieved 2017-01-17.

- ^thecreator (2008-08-28). 'Quicken Community - Quicken 2009 Bug List'. Quicken Community. Archived from the original on 2009-04-08. Retrieved 2017-01-17.

- ^Elmblad, Shelley (2009-01-14). 'The Best and Worst Features in Quicken'. About.com. Archived from the original on 2009-02-06. Retrieved 2017-01-17.

- ^Arar, Yardena (2009-10-29). 'Intuit Quicken Premier 2010'. Quicken Premier. Retrieved 2010-01-16.

- ^'Quicken Support - Quicken Community'. Intuit. Retrieved 2016-07-07.

- ^'Online center won't 'Update send' bills/Quicken Bill Pay missing from OSU (updated title)'. community.quicken.com.

- ^'Intuit releases Lion-compatible Quicken 2007'. CNET. 2012-03-08. Retrieved 2016-07-07.

- ^Snell, Jason (2010-02-24). 'After delays and criticism, Intuit releases Quicken Essentials for Mac'. Macworld. Retrieved 2016-07-07.